Expenses

What Are Expenses

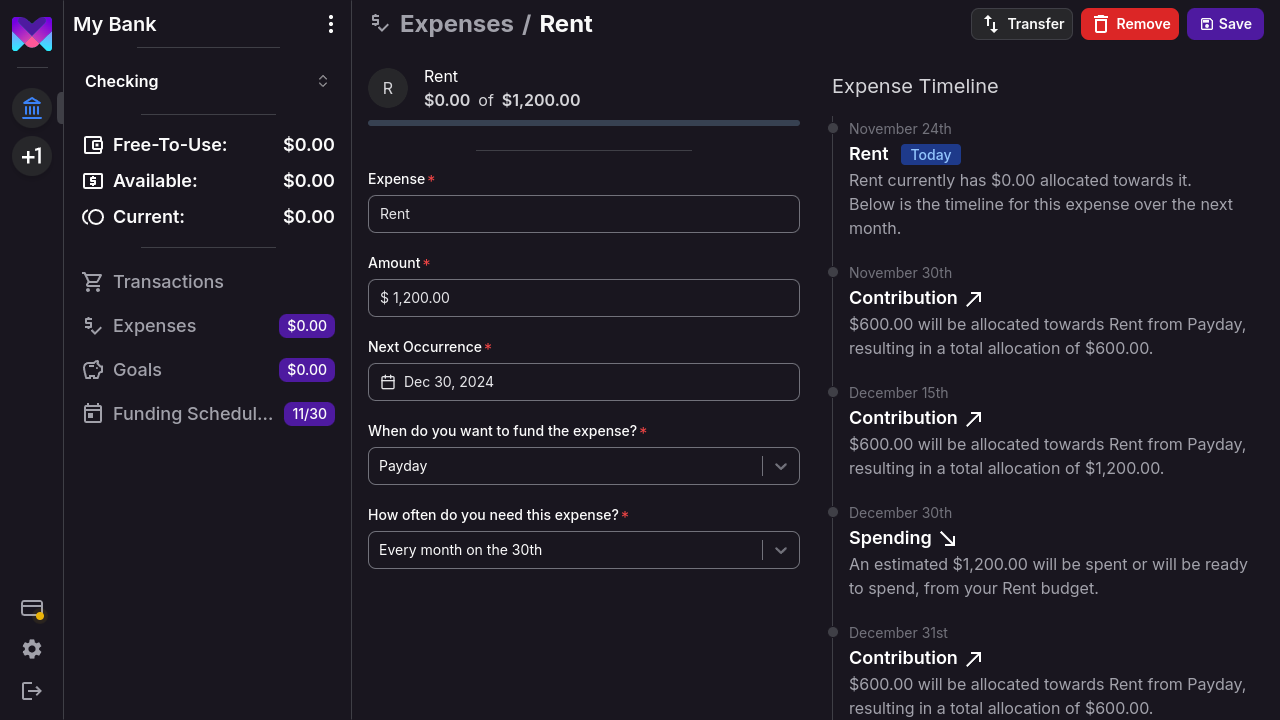

Expenses are how monetr helps you manage recurring financial obligations, such as rent, car payments, or subscriptions. The platform tracks how much money is required for each expense and when it’s due. Using Funding Schedules, monetr automatically sets aside a portion of the expense from each paycheck. This approach ensures that you don’t need to cover the full amount from a single paycheck. As a result, your Free-To-Use funds should remain consistent with every paycheck.

This approach is similar to envelope budgeting, where funds are allocated to specific categories to ensure they’re available for designated expenses. Like envelope budgeting, monetr helps you plan ahead and manage your cash flow effectively. However, monetr automates the process by calculating how much to set aside based on your paycheck schedule and expense deadlines.

It’s best to create a separate expense entry for each recurring obligation. For example, setting up a monthly expense for rent due on the first of the month ensures you’ll always have enough funds available to pay it on time. However, expenses are less suitable for irregular costs, such as dining out or saving for large, infrequent purchases.

Each expense is tied to an individual bank account. If a regular expense is paid from multiple accounts, create separate expense entries in monetr for each account. Assign the appropriate amount to each entry based on how much each account contributes to that expense.

Looking for something else?

If you’re trying to save for a one-time financial target or track contributions toward a larger goal, consider using

monetr’s Goals feature instead. Goals are ideal for managing non-recurring targets like vacations, down

payments, or paying off loans, and they provide more flexibility in tracking usage over time.

Create an Expense

To create an expense, navigate to the expense view for your current account by clicking Expenses in the sidebar.

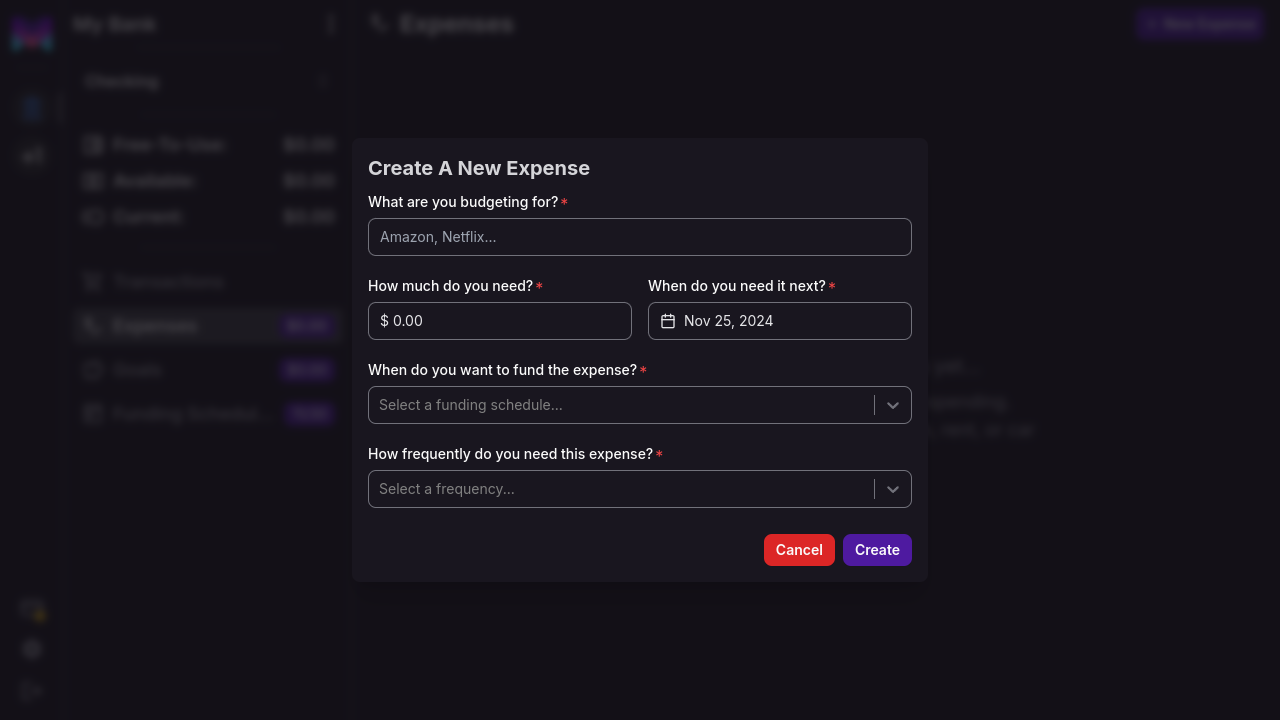

Then, click New Expense in the top navigation to open the creation modal.

How Much Do You Need?

monetr needs to know the amount required for the expense. If the amount varies (e.g., utility bills), set it to the highest expected amount within reason. For example, you might set a utility bill to its seasonal peak. You can adjust the amount as needed, and any surplus funds will reduce the contribution required from future paychecks.

When Do You Need It Next?

monetr needs the next due date for the expense. This date determines how the expense repeats going forward. You can update it later if necessary.

If the expense’s due date varies, select a date a few days before it’s typically due. This ensures funds are available in advance. Contributions will still align with your funding schedule.

How Do You Want to Fund It?

If you haven’t already created a Funding Schedule, you’ll be prompted to do so here. Otherwise, select an existing schedule to match how you want to contribute. For example, if your funding schedule aligns with your paychecks, you’ll contribute a portion of the expense each payday.

How Frequently Do You Need This Expense?

Choose how often the expense occurs. monetr will repeat the expense on this frequency and ensure funds are set aside before the due date.

Supported frequencies include:

- Weekly

- Every other week

- Monthly

- Every other month

- Every third month (quarterly)

- Every six months

- Yearly

If the date selected in When Do You Need It Next? is the 1st, 15th, or last day of the month, these additional options are available:

- 1st and 15th of every month

- 15th and last day of every month

How Expenses Help

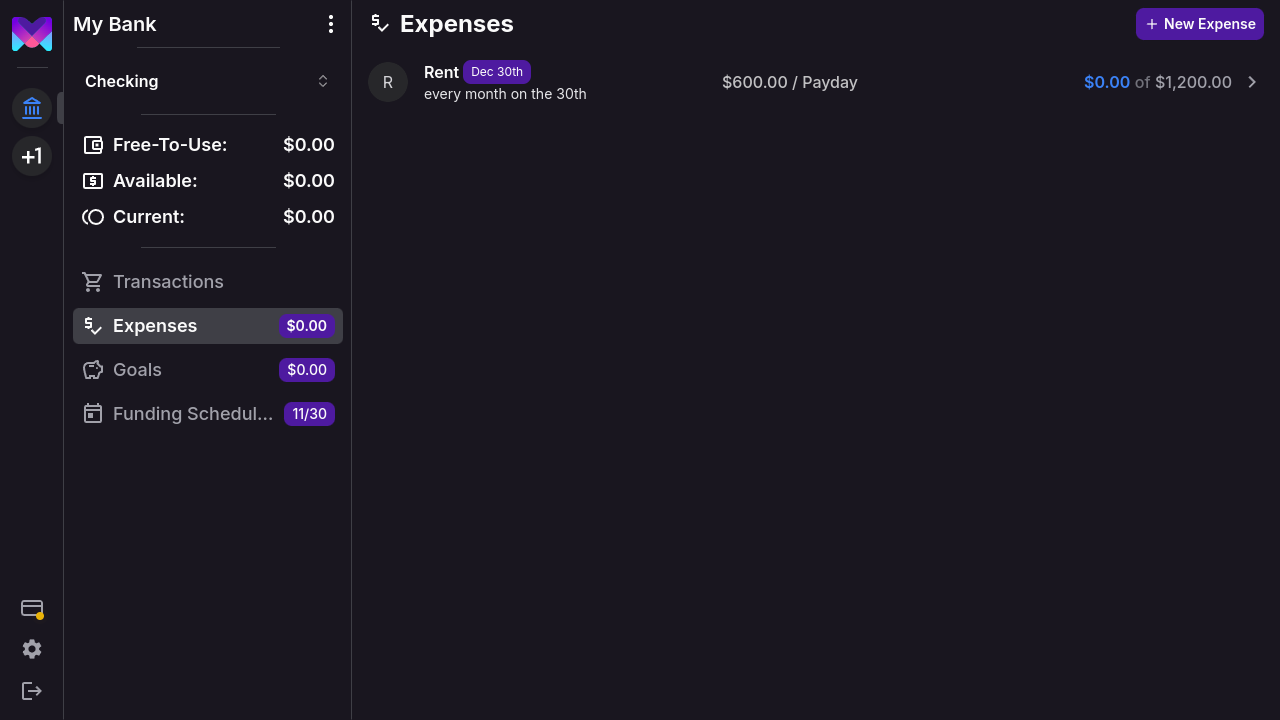

After creating expenses, monetr calculates contributions based on your funding schedule. For example, if you’re paid twice a month, half the amount will be set aside each paycheck to balance contributions.

In the expenses overview, you’ll see:

- The next due date (e.g., December 30th in the screenshot above).

- How frequently the expense occurs (e.g., monthly on the 30th).

- The amount to be contributed next paycheck.

- The current amount set aside for the expense (e.g., $0.00 in this example).

Expense Details

Click on an individual expense to view more details.

This page provides all the information available in the list view and allows you to modify the expense if needed. You can also Transfer funds to adjust the amount set aside for the expense manually.

When you remove an expense, any funds set aside for it are returned to your Free-To-Use amount.

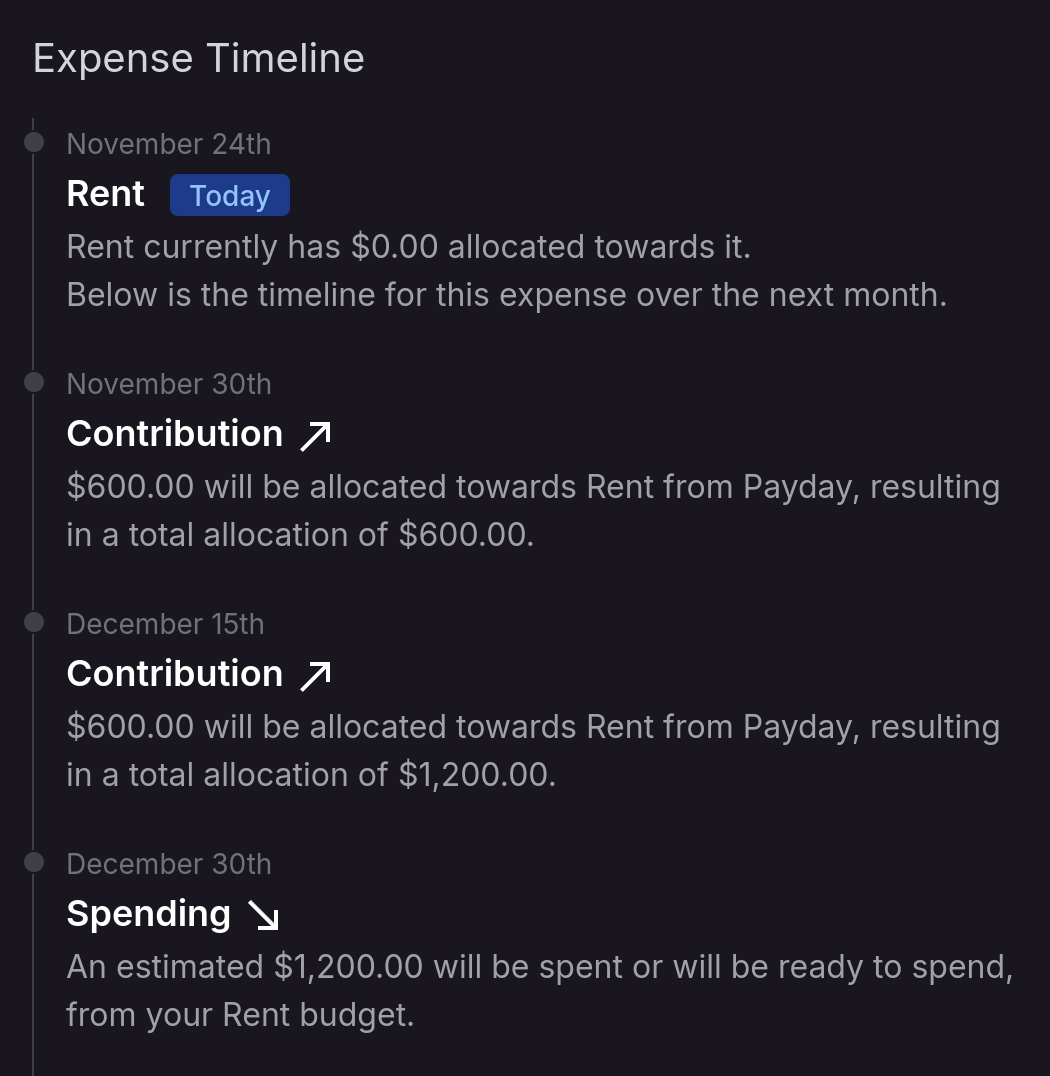

Expense Timeline

Each expense includes a timeline showing predicted contributions and expected usage. This helps you track when funds will be allocated and when the expense is due.