Funding Schedules

What Are Funding Schedules

Funding schedules let monetr know when to allocate funds for your budgets. Think of funding schedules as “when do you get paid.” Allocating funds each time you get paid ensures that your Free-To-Use funds remain predictable and consistent.

You can create multiple funding schedules if needed, such as putting money aside weekly or only once a month. Every Expense or Goal you create must be tied to a funding schedule.

Funding schedules are unique to each bank account, not to the entire bank connection. For example, if you have both a checking and savings account at the same bank, you may want separate funding schedules for each account. You can create multiple funding schedules per account, but each must have a unique name within the account.

This flexibility allows, for instance, a primary funding schedule for your checking account, covering most of your paycheck, and a secondary schedule for your savings account, allocating leftover funds.

Create a Funding Schedule

To create a funding schedule, navigate to the funding view of your current account by clicking Funding Schedules in the sidebar.

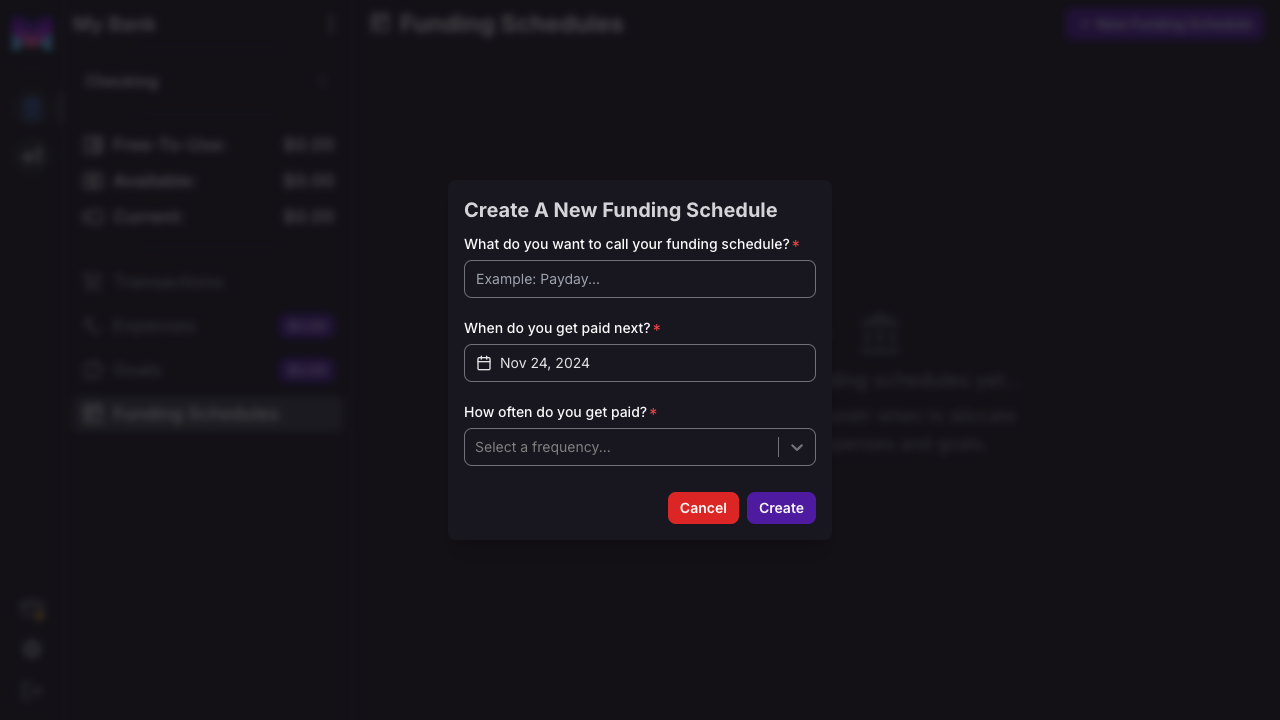

Then, click New Funding Schedule in the top navigation to open the creation modal.

When Do You Get Paid Next?

This date acts as a baseline for the funding schedule’s recurrence. It influences the options available in the How Often Do You Get Paid? dropdown.

For example, if you’re paid every two weeks on Friday, select the next Friday you’ll be paid.

How Often Do You Get Paid?

monetr supports the following recurring patterns:

- Weekly

- Every other week

- Monthly

- Every other month

- Every third month (quarterly)

- Every six months

- Yearly

If the date chosen in When Do You Get Paid Next? is the 1st, 15th, or last day of the month, these additional options are available:

- 1st and 15th of every month

- 15th and last day of every month

Additional Options

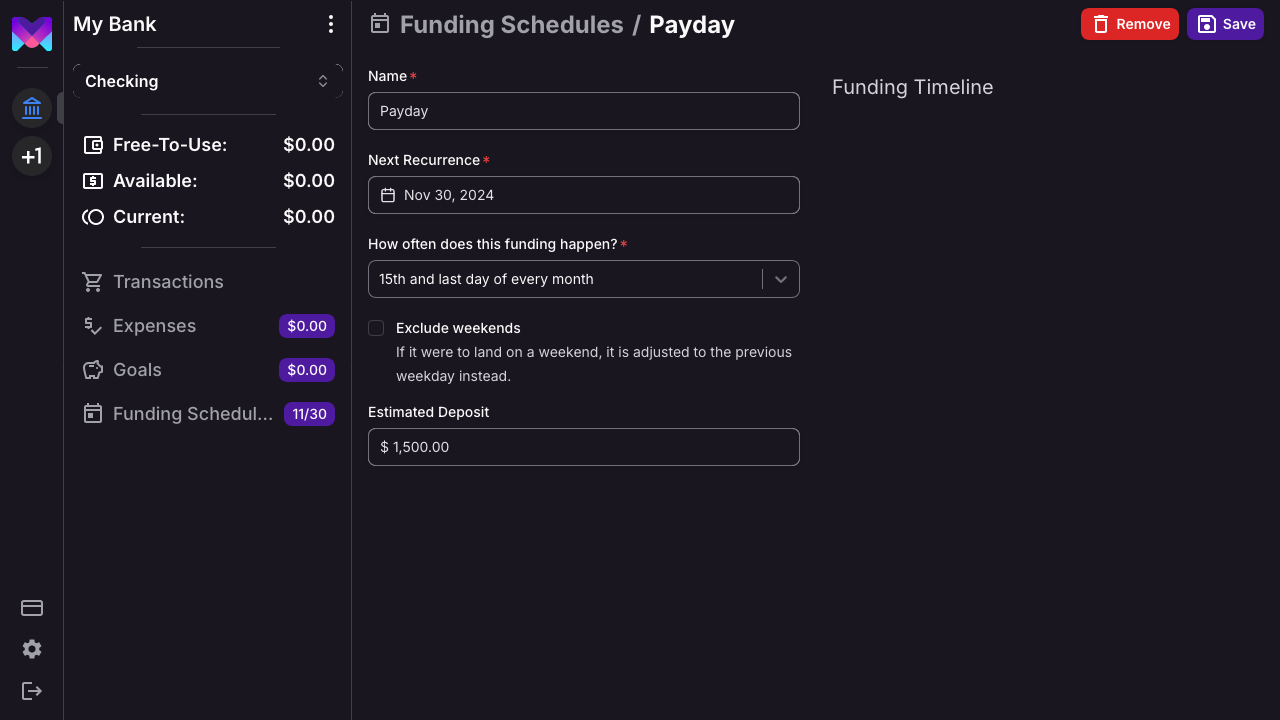

Funding schedules offer two optional features for a more tailored budgeting experience. These options are visible on the funding schedule’s details page.

Excluding Weekends

If you get paid on the 1st and 15th, or 15th and last day of the month, your paycheck may arrive earlier when the date falls on a weekend. Deposits aren’t typically processed on weekends or holidays. To align your funding schedule with when funds are likely deposited, enable Exclude Weekends in the details page.

When enabled, if the next scheduled funding date falls on a Saturday or Sunday, it will adjust to the previous weekday.

Estimated Deposit

Providing an estimated deposit amount helps monetr’s forecasting tools. This allows you to:

- Anticipate how much will be set aside from each paycheck.

- See an estimate of your Free-To-Use funds after budgeting.

Estimated Contribution

Once you’ve linked Expenses or Goals to a funding schedule, monetr calculates an “Estimated Contribution” displayed on the funding schedule page. This value represents how much monetr expects to allocate toward your budgets on the next funding date.

Ensure the estimated contribution is less than your expected deposit. If it exceeds your deposit, you may not have enough funds to cover all expenses.

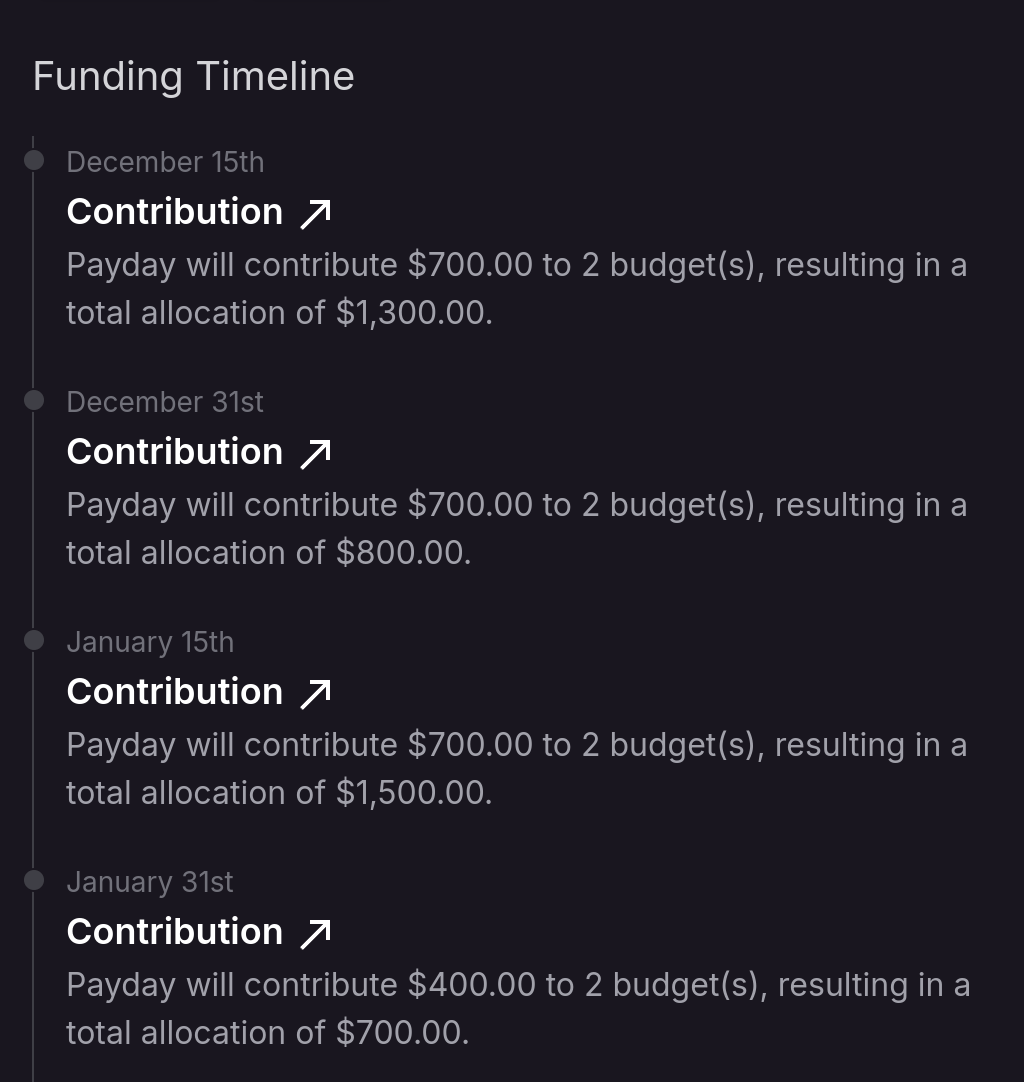

Funding Timeline

As you create more Expenses and Goals, the funding schedule provides insights into upcoming funding events.

This timeline shows:

- How much money is expected to be allocated each time you’re paid.

- If you’ve specified an Estimated Deposit, it also shows the leftover amount after accommodating your budgets.